Celsius Holdings (CELH): A Deep Dive into One of the Fastest Growing Energy Drinks

Celsius Holdings (CELH): A Deep Dive into One of the Fastest Growing Energy Drinks

Introduction

Celsius Holdings, Inc. (NASDAQ: CELH) continues to dominate the energy drink market, driven by an innovative product line tailored to health-conscious consumers. With stellar financial growth, strategic partnerships, and bold expansion plans, Celsius is quickly rising as a top player in the beverage industry. Backed by a strong partnership with PepsiCo, its latest earnings reports reveal why this company could be a long-term winner. Below, we’ll delve into the company’s financials, stock-based compensation, management insights, and growth outlook.

Business Overview

Celsius has carved out a unique niche within the energy drink market, focusing on consumers who prefer health-forward beverages without artificial sweeteners or preservatives. What has set Celsius apart is its ability to marry functional benefits with taste, a strategy that has helped it gain market share at the expense of legacy brands like Red Bull and Monster.

One of the most pivotal developments in recent years has been the company's PepsiCo distribution agreement, which began in 2022. This partnership has expanded Celsius' footprint across retail channels, including convenience stores, grocery chains, and non-tracked channels like Amazon and foodservice. By the second quarter of 2023, Celsius had already secured the number three spot in the U.S. energy drink market, boasting an 8.6% market share, which doubled from 4.3% a year earlier. According to John Fieldly, Celsius CEO, "Our partnership with Pepsi has exceeded expectations, and we continue to see opportunities for growth across both tracked and non-tracked channels".

Celsius has also expanded internationally, with Canada, the U.K., and Ireland showing promising growth. Further expansion plans into Australia, New Zealand, and France are expected later in 2024 and 2025.

Income Statement Highlights

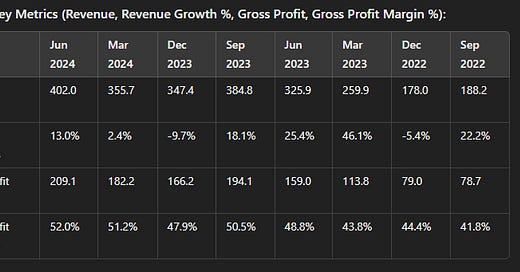

Celsius has continued its impressive revenue growth in Q2 2024, with $402 million in revenue, a 23.35% increase year-over-year. Gross profit also climbed to $209 million, up from $159 million in Q2 2023. The company’s gross margin improved to 52%, driven by lower raw material and freight costs. The company has consistently outpaced earnings expectations, delivering $0.28 EPS in Q2 2024, up 63% year-over-year.

Celsius has managed to grow its market share and sales volume, even in a competitive environment. During the Q2 2024 earnings call, CFO Jarrod Langhans highlighted that Celsius unit sales volume grew by 30.6%, even as the broader energy drink category remained flat.

According to Fieldly, “Celsius has continued to drive the category’s growth, contributing 47% of all category growth in Q2 2024 alone, outpacing every competitor”.

Balance Sheet Strength

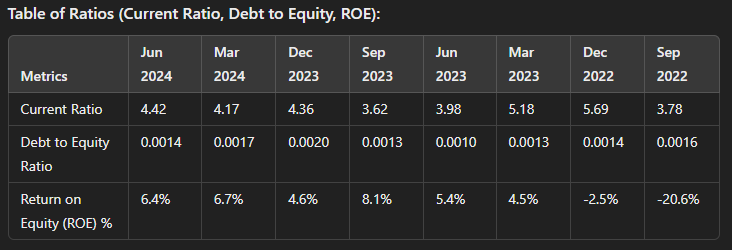

Celsius' balance sheet remains a standout, providing a stable foundation for future growth. As of June 2024, the company held $903 million in cash and minimal debt of just $1.8 million. This low debt, combined with a strong current ratio of 4.42, reflects Celsius' strong liquidity and ability to invest in its future growth without the burden of significant financial obligations.

Cash Flow Overview

Celsius’ ability to convert revenue into operating cash flow has been another strong point. For Q2 2024, the company generated $39.6 million in operating cash flow. Though there was some variability in past quarters, partly due to seasonal effects and inventory builds, Celsius maintained positive free cash flow (FCF), with $10.9 million in FCF in Q2 2024. This robust cash flow allows Celsius to self-finance its growth initiatives, reducing the need for external debt.

Stock-Based Compensation

Celsius has been using stock-based compensation to attract and retain top talent, though it has been trending down as a percentage of revenue. In Q2 2024, $4.7 million was allocated for stock-based compensation, down from $5.7 million in the same quarter of the previous year. This reduction signifies greater cost efficiency as revenues grow, with stock-based compensation now representing 1.17% of revenue, compared to 1.75% a year ago.

Management is cautious about diluting shareholder value through excessive stock-based compensation, and this downward trend is a positive signal for long-term investors.

Growth Expectations and Management Insights

Celsius management is bullish on the company's growth prospects, both domestically and internationally. During the Q2 2024 earnings call, Fieldly highlighted several key drivers of future growth, including the expansion into new international markets and the launch of innovative new products such as new flavors and powder-based options. Fieldly noted, “We expect continued strong performance in North America, but international markets, particularly in Europe and Asia-Pacific, will be the primary growth drivers over the next 3 to 5 years”.

In the U.S., the company's expanding market share in the convenience store channel has been a major growth engine. Fieldly emphasized that Celsius continues to gain shelf space in convenience stores, increasing its average SKUs per store by over 35% in the first half of 2024.

Looking forward, EPS estimates of $0.81 in 2024, $1.04 in 2025, and $1.35 in 2026 suggest continued robust earnings growth, with annual growth rates of 28.4% and 29.81%.

Valuation: P/E and PEG Ratios

At a current stock price of $32, Celsius’ 2024 P/E ratio is 39.51, declining to 30.77 for 2025, and 23.70 for 2026. While these multiples may seem high, they reflect the company's growth potential. When considering its PEG ratio, which factors in earnings growth, the 2024 PEG ratio of 1.39 and the 2025 PEG ratio of 1.03 suggest that Celsius is still attractively valued given its earnings trajectory.

If the stock price drops to $31, the 2025 PEG ratio would dip below 1, further enhancing its attractiveness to growth investors.

Final Recommendation: A Strong Buy for Growth Investors

Celsius Holdings is a company on the rise, showing strong revenue growth, improving profitability, and disciplined financial management. The PepsiCo partnership continues to be a game-changer, expanding Celsius' market share and helping to scale its operations. Meanwhile, international expansion and product innovation provide additional avenues for future growth.

With strong earnings growth, a solid balance sheet, and reasonable valuations, Celsius Holdings is a buy for long-term, growth-oriented investors. The company’s commitment to innovation and its strategic focus on international expansion make it an exciting opportunity in the competitive energy drink market.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always consult a financial advisor before making investment decisions.