GEN Restaurant Group, Inc. (NASDAQ: GENK): A Stock I'm Watching for 2026

Introduction

GEN Restaurant Group, Inc. (GENK) is pioneering an exciting, customer-driven dining experience with a unique “cook-it-yourself” Korean BBQ model. Since its inception, GENK has expanded from a niche restaurant to a growing national chain, leveraging efficient labor and operational models that maximize seating and limit kitchen staffing needs. The company’s average revenue per restaurant of $4-5 million, along with its potential for rapid expansion into high-growth regions, positions it as a high-upside investment opportunity within the restaurant sector.

Business Overview

GENK’s business is focused on a Korean BBQ dining experience where customers cook at their tables, a setup that drastically reduces kitchen space and labor costs while adding an interactive appeal. GENK’s operating model is supported by three key strategies:

Core Dining Concept: The company’s core “all-you-can-eat” model has strong unit-level economics, with high revenue per restaurant and a payback period of approximately 2.2 years.

Geographic Expansion: Initially rooted in California, GENK has expanded into Texas, Florida, and other states with lower operational costs. Expansion outside California not only brings growth but also lowers labor and occupancy expenses, which could support higher margins.

Premium Menu Enhancements: In 2024, GENK introduced premium menu items priced at $20 per customer, aimed at increasing average customer spend. CEO David Kim noted in the Q2 2024 earnings call that initial results are positive but vary depending on location and staff upsell training. This addition, along with new alcoholic beverages, is projected to drive both higher check sizes and overall revenue.

Income Statement Analysis

GENK’s revenue growth trajectory has remained strong, supported by both new store openings and an increase in per-customer spend. The company projected total revenue between $200-$205 million for 2024, a rise from $181 million in 2023. This growth primarily stems from GENK’s consistent addition of new stores, with a target of reaching 70 locations by 2026.

Gross margins have also improved, driven by labor efficiencies in the company’s customer-focused cooking model. Operating margin targets of 18-20% have been met, with further potential upside as more stores open in low-cost regions. In terms of operational performance, GENK’s model is supported by an EBITDA margin of 20%, which could expand as new locations stabilize and the premium menu is fully rolled out.

Balance Sheet Analysis

GENK’s balance sheet reflects financial discipline, particularly in its conservative use of cash and debt. As of June 2024, the company reported cash reserves of $29.2 million, largely driven by positive free cash flow from its operations. This financial strength has allowed GENK to finance much of its growth internally, reducing reliance on high-cost debt. The company’s debt-to-equity ratio is in a comfortable range, giving GENK flexibility as it continues expanding.

Moreover, GENK’s low debt profile positions it well in a high-interest rate environment. CFO Tom Croal highlighted in Q2 2024 that the company’s strong cash flow is enabling it to “fund expansion without relying on external financing sources,” which he described as a cornerstone of GENK’s financial strategy.

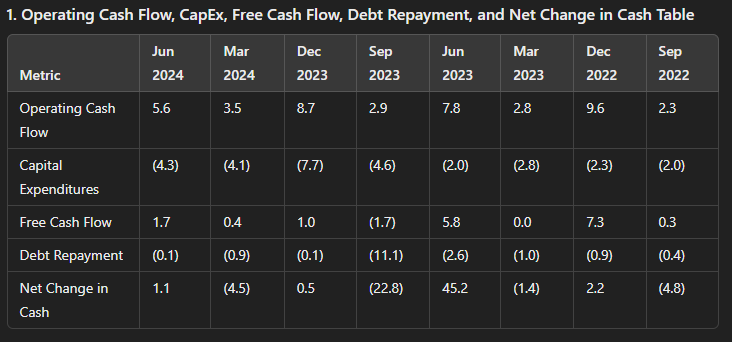

Cash Flow Statement Analysis

GENK’s positive cash flow has proven vital to its growth strategy, allowing the company to finance new restaurant openings. Cash flow from operations has remained positive even as capital expenditures have increased due to new market entries. Free cash flow has fluctuated, reflecting upfront costs associated with these openings, but management expects it to stabilize as these new stores mature and begin generating returns.

Capital expenditures in 2024 have primarily been allocated to new restaurants in strategic regions with high growth potential, a decision which management expects to strengthen revenue while improving the company’s operational efficiency.

Earnings Growth and Projections

GENK’s growth plan includes double-digit revenue growth, primarily achieved through new location openings and strategic menu expansions. Management projects double digit annual revenue growth, which should bring total revenue to approximately $315 million by 2026. This growth trajectory is bolstered by high-margin menu additions and a steady rise in average check sizes.

The company’s earnings potential is substantial. Based on projected revenue and an EBITDA margin of 20%, GENK’s EPS for 2026 could range between $1.34 and $3.35, with actual results dependent on the success of expansion initiatives and premium menu adoption.

Valuation Analysis Using Forward 2026 EV/Sales and EV/EBITDA

To assess GENK’s valuation, we use EV/Sales and EV/EBITDA multiples. Assuming GENK’s stock price holds at around $9 and an enterprise value of $300 million, here’s a closer look at the potential upside:

EV/Sales:

At a 2x EV/Sales multiple: EV = $315 million x 2 = $630 million, implying a stock price of approximately $18.

At a 3x EV/Sales multiple: EV = $315 million x 3 = $945 million, implying a stock price of approximately $27.

At a 4x EV/Sales multiple: EV = $315 million x 4 = $1.26 billion, implying a stock price of approximately $36.

EV/EBITDA:

At a 10x EV/EBITDA multiple (with projected 2026 EBITDA of $63 million): EV = $63 million x 10 = $630 million, implying a stock price of $18.

At a 12x EV/EBITDA multiple: EV = $63 million x 12 = $756 million, implying a stock price of $22.

At a 15x EV/EBITDA multiple: EV = $63 million x 15 = $945 million, implying a stock price of $27.

These valuation scenarios suggest a price range of $18 to $36 per share by 2026, depending on how GENK’s expansion strategy plays out and the market’s willingness to assign growth multiples. In light of comparable restaurant chains that trade at higher EV/Sales and EV/EBITDA multiples, GENK appears positioned for substantial upside.

Final Verdict

GEN Restaurant Group is positioned at an inflection point, transitioning from a regional favorite to a potential national chain. Its model of customer-driven cooking, efficient labor structures, and high-margin menu items provides an appealing growth narrative within the dining industry. While the stock’s current valuation may appear modest, GENK’s expansion plans and earnings potential suggest a significant revaluation opportunity.

Investors seeking exposure to a high-growth, unique dining experience should consider GENK as an appealing candidate for long-term growth. With management’s clear commitment to growth and profitability, GENK presents a compelling “Buy” for those focused on both growth and value in the restaurant sector.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always consult a financial advisor before making investment decisions.