The Honest Company (HNST) Stock Analysis: Path to Profitability Amid Rising Revenue?

I often find myself contemplating investments during the most ordinary moments. Recently, while changing my six-month-old’s diaper, I couldn't help but wonder if The Honest Company—the brand that seems to be everywhere in our household—was publicly traded. Given their growing presence in the baby care market, I decided to dig deeper. To my surprise, I discovered that they are indeed a publicly traded company. Intrigued by their widespread consumer reach, I embarked on a fundamental analysis to evaluate whether this familiar brand could also be a promising investment.

The Honest Company (HNST) Stock Analysis: Path to Profitability Amid Rising Revenue?

The Honest Company (NASDAQ: HNST), known for its clean and sustainable baby and personal care products, has captured attention due to its commitment to consumer health and environmental standards. Despite its solid market presence and significant brand recognition, the company continues to face profitability challenges while showing notable improvements in key financial areas such as revenue growth, gross margins, and cash flow. This report dives into The Honest Company’s financial health by evaluating its income statement, balance sheet, and cash flow, while also considering share dilution, growth prospects, and profitability goals to determine the stock’s investment potential.

Income Statement: Encouraging Growth but Persistent Losses

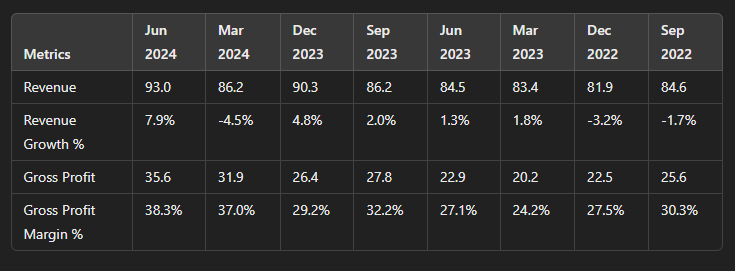

The Honest Company has consistently grown its top line over the past few years, even as it struggles with profitability. In Q2 2024, revenue came in at $93 million, a 10% year-over-year (YoY) increase from $84.5 million in Q2 2023. This growth was driven primarily by increased distribution partnerships with major retailers such as Walmart and Amazon, alongside higher sales in key product categories like baby care and wipes.

The company has shown impressive improvement in its gross profit, which rose to $35.6 million in Q2 2024, up from $22.9 million in the same quarter the previous year. This equates to a gross margin of 38%, a significant improvement over the 27.1% margin recorded in Q2 2023. The expansion of gross margins is attributed to several factors, including better supply chain management, cost savings initiatives, and selective price increases across product lines.

However, despite the upward trajectory in revenue and gross profit, The Honest Company remains unprofitable at the operating level. In Q2 2024, the company reported an operating loss of $4.0 million, an improvement over the $13 million operating loss from Q2 2023. The primary drag on operating income continues to be high SG&A (Selling, General, and Administrative) expenses, which include significant outlays for marketing, stock-based compensation, and strategic brand-building initiatives. The company also incurred one-time expenses related to an accelerated stock grant tied to the founder’s exit, further weighing down operating income.

The company's net loss for Q2 2024 was $4.1 million, a significant improvement from the $13.4 million net loss in Q2 2023. While losses persist, this reduction reflects better cost management and efficiency improvements in its core operations. The Honest Company is showing positive signs of operational improvement, but it still faces hurdles in its journey toward consistent profitability.

Balance Sheet: Strengthened Liquidity but Declining Assets

The Honest Company’s balance sheet remains relatively strong, with a robust liquidity position and ongoing debt reduction efforts. As of Q2 2024, the company reported current assets of $162.2 million, up from $144.5 million in Q2 2023. This includes a substantial increase in cash reserves, which rose to $36.6 million from $17.8 million YoY, driven by positive cash flow from operations and tighter inventory management.

On the liabilities side, current liabilities stood at $52.9 million, keeping the company’s current ratio at a healthy 3.07. This strong ratio indicates that The Honest Company is well-positioned to cover its short-term obligations. The company’s debt levels have also been reduced, with total debt falling to $25.87 million from $33.8 million in Q2 2023, reflecting the company’s focus on deleveraging its balance sheet while improving its overall financial flexibility.

However, the company’s total assets have slightly declined, reflecting its efforts to streamline operations and reduce working capital requirements, particularly through a 36% reduction in inventory over the past year. This decline in inventory was part of a strategic decision to optimize working capital, though it has contributed to the overall reduction in asset size.

Cash Flow: Positive Momentum Despite Operating Losses

Despite the continued losses at the operating and net income levels, The Honest Company has made significant strides in generating positive cash flow. In Q2 2024, the company reported positive operating cash flow of $2.9 million, marking a significant improvement over negative cash flows in earlier periods. The shift to positive cash flow is largely due to better working capital management, particularly reductions in inventory, and disciplined cost controls.

In terms of free cash flow (FCF), the company posted a positive FCF of $5 million in Q2 2024. This was driven by the low capital expenditures (CapEx) of just $0.1 million, demonstrating the capital-light nature of The Honest Company’s business model. With minimal CapEx, the company can generate free cash flow even while it remains unprofitable on a net income basis.

The company’s ability to generate positive free cash flow, coupled with its improved cash reserves, provides it with a level of financial stability that should allow it to weather ongoing challenges while working toward profitability.

Share Dilution: Modest but Persistent

Share dilution is a concern for investors, particularly as The Honest Company continues to rely on stock-based compensation to attract and retain talent. As of Q2 2024, the company had 100.08 million shares outstanding, up from 96.5 million shares in Q2 2023. This reflects a 3.7% increase in shares YoY, which, while not excessive, does dilute existing shareholders. The company’s reliance on stock-based compensation, particularly in the tech-driven and competitive consumer goods sector, will need to be balanced with long-term shareholder value.

Overview of Stock-Based Compensation

Stock-based compensation (SBC) has been a significant expense for The Honest Company, particularly in Q2 2024 when a one-time accelerated stock grant related to the founder’s separation contributed to a spike in SG&A expenses, raising them to $26 million. Without this exceptional expense, SG&A would have been $19 million, indicating that SBC was a large contributor to the increase. In Q2 2024, SBC accounted for over 7% of total revenue—a substantial figure compared to previous quarters where SBC typically ranged from 3-5% of revenue.

Management has acknowledged the impact of SBC on the company’s operating income and shareholder dilution. They are working to reduce these expenses over time while still using stock-based compensation as a tool to retain and attract talent. Moving forward, the company plans to better manage these costs as part of its broader effort to improve margins and achieve consistent profitability.

Growth and Profitability Goals: On the Path to Positive EBITDA

The Honest Company has set clear goals for both revenue growth and profitability. Management projects mid to high single-digit revenue growth for the full year 2024, driven by expanded distribution, particularly in key retail channels like Walmart, Amazon, and Target, as well as product innovation in high-demand segments such as baby care and wipes.

In terms of profitability, the company has made significant progress. For the third consecutive quarter, The Honest Company reported positive adjusted EBITDA, and management expects to achieve full-year Adjusted EBITDA of $15 million to $18 million in 2024. While the company has yet to achieve positive net income, its focus on improving gross margins and reducing SG&A expenses suggests that consistent profitability could be on the horizon in the next couple of years.

Valuation: Undervalued Relative to Peers?

The Honest Company’s Price-to-Sales (P/S) ratio stands at 0.97, making it relatively undervalued compared to peers in the personal care space. For example, Coty Inc. (COTY) trades at a P/S ratio of around 1.5, while Kenvue (KVUE) trades closer to 3.0. The company’s relatively low valuation, combined with improving gross margins and positive free cash flow, suggests that HNST could be an attractive opportunity for investors willing to bet on a longer-term turnaround.

Additionally, the company’s Price-to-Free Cash Flow (P/FCF) ratio of 19.7 indicates that the stock is generating sufficient cash flow relative to its price, which is a positive indicator for future growth. However, this valuation must be tempered by the fact that the company remains unprofitable and faces significant competitive pressures in its core markets.

Conclusion: Hold Until Profitability is in Sight

The Honest Company has made significant strides in improving its financial performance, with strong revenue growth, expanding gross margins, and positive cash flow. However, persistent net losses, high SG&A expenses, and share dilution continue to weigh on the stock. While the company’s relatively low valuation makes it an intriguing investment prospect, particularly for those betting on a future turnaround, the lack of consistent profitability means that caution is warranted.

For now, the prudent course of action is to Hold. Investors should watch closely for continued margin expansion, progress toward net profitability, and any strategic moves that could further bolster revenue growth. If the company can deliver on its profitability goals and maintain positive free cash flow, there could be significant upside potential in the future.