Introduction

Veeva Systems Inc. (NYSE: VEEV) stands as a dominant force in cloud-based solutions for the life sciences industry, offering an extensive suite of software and data solutions designed to streamline clinical, regulatory, and commercial workflows. Serving pharmaceutical, biotechnology, and medical device companies, Veeva has established itself as an indispensable partner for navigating the complexities of a heavily regulated industry. With its innovative approach and focus on customer-centric solutions, the company empowers its clients to bring therapies to market more efficiently while ensuring strict compliance. As an investment opportunity, Veeva combines steady financial performance with robust growth potential, making it an intriguing choice for growth-oriented investors looking to capitalize on the expanding healthcare and life sciences sectors.

Business Overview

Veeva Systems operates through two primary segments, Commercial Cloud and Development Cloud, both integral to its business model.

The Commercial Cloud segment is centered on solutions that support sales, marketing, and customer engagement for life sciences companies. A flagship product in this segment is Veeva Vault CRM, a customer relationship management tool designed to help pharmaceutical sales teams manage their interactions with healthcare professionals. Vault CRM is particularly valued for its integration with regulatory compliance systems, enabling seamless documentation and approval workflows for promotional materials.

The Development Cloud focuses on clinical, regulatory, and quality processes for drug development. Tools like Veeva Vault Clinical support clinical trials by streamlining data collection, monitoring, and compliance, while Veeva Vault RIM (Regulatory Information Management) simplifies regulatory submissions and lifecycle management. These products are indispensable for companies navigating complex approval processes in heavily regulated environments.

Financial Performance

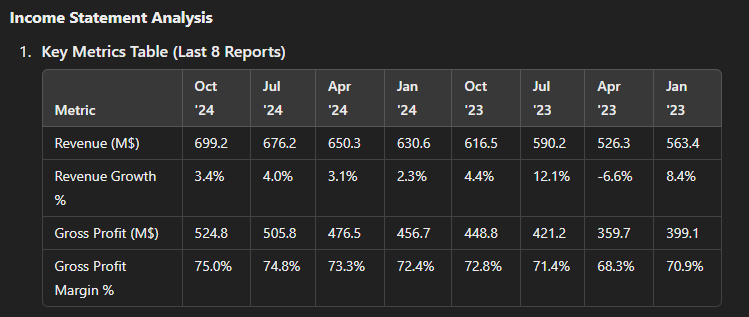

Veeva’s financial performance underscores its robust position in the market. The company has demonstrated consistent revenue growth, with its fiscal year 2025 third-quarter revenue reaching $699.2 million, an 8.5% increase year over year. Gross profit margins remain impressive at 75%, reflecting strong pricing power and operational efficiency.

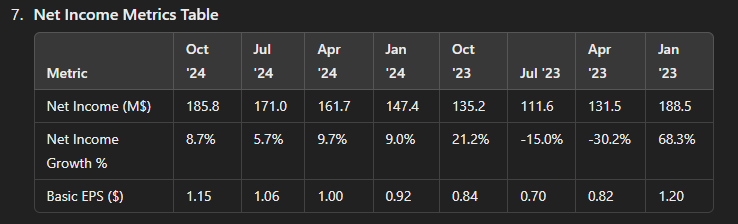

Operating income for the same period stood at $181.4 million, with an operating margin of 25.9%, a notable improvement driven by higher subscription revenues and disciplined cost management. Net income also saw significant growth, increasing 37.5% year over year to $185.8 million, while basic earnings per share (EPS) rose to $1.15.

These financial metrics highlight Veeva’s ability to deliver profitability alongside growth, a rare combination in the SaaS sector.

Balance Sheet and Cash Flow

Veeva’s balance sheet remains a pillar of strength, characterized by ample liquidity and minimal debt. The company reported $5.45 billion in current assets compared to $857 million in current liabilities, resulting in a robust current ratio of 6.4x. Cash reserves exceeded $5 billion, providing the company with substantial flexibility to pursue acquisitions, invest in innovation, or return value to shareholders through buybacks. Moreover, Veeva’s debt-to-equity ratio stands at a conservative 0.013x, highlighting its prudent approach to financial management.

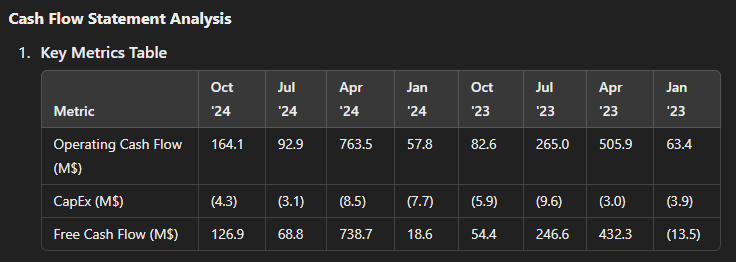

On the cash flow front, Veeva generated $126 million in operating cash flow during the third quarter of fiscal year 2025, while keeping capital expenditures modest at $4.3 million. This resulted in a strong free cash flow position, enabling the company to reinvest in growth opportunities while maintaining financial stability.

Growth Opportunities

Veeva Systems has outlined several strategic initiatives to sustain its market leadership and drive shareholder value. The company’s focus on product innovation, geographic expansion, and customer success positions it to maintain robust growth in the years ahead.

Management projects mid-teens revenue growth and aims to sustain operating margins of approximately 35% in the near term, supported by a high-margin subscription model and disciplined cost management. For fiscal year 2025, Veeva has provided specific guidance, expecting total revenues between $2.722 billion and $2.725 billion, non-GAAP operating income of approximately $1.12 billion, and non-GAAP fully diluted earnings per share of approximately $6.44.

Future Product Expansion

Product innovation remains a cornerstone of Veeva’s strategy. The company is investing heavily in its Development Cloud portfolio, particularly within the Vault Quality Suite and Vault CRM. As of the most recent quarter, more than 600 customers have adopted at least one of the seven Vault Quality Suite applications, underscoring strong demand for its quality management solutions. Veeva also added 25 new customers to this suite in the last quarter, further solidifying its market position.

In the Commercial Cloud segment, Veeva’s Vault CRM is gaining traction as the next-generation solution for customer relationship management in the life sciences sector. Management reported that seven customers have migrated from the legacy Veeva CRM to Vault CRM, with all migrations on track for completion by year-end. Additionally, a fourth top 20 biopharma company has selected Vault CRM as its commercial foundation. The latest release of Vault CRM, which includes the full functionality of Veeva CRM alongside new capabilities, marks a significant milestone in the company’s CRM leadership.

Looking ahead, Veeva is introducing new AI-powered features to enhance its offerings. These include CRM Bot (a generative AI assistant), Voice Control (a voice interface leveraging Apple Intelligence), and MLR Bot for Vault PromoMats, which uses a Veeva-hosted large language model to streamline the review and approval of promotional materials. These innovations are expected to launch by late 2025 and further differentiate Veeva’s products in the market.

Geographic Expansion

Emerging markets such as Latin America and Asia represent significant growth opportunities for Veeva. With increasing R&D activity and growing regulatory complexity in these regions, demand for Veeva’s solutions is expected to rise. Management continues to view geographic expansion as a key lever for long-term growth, with strategic investments planned to capture these opportunities.

Financial and Operational Outlook

Veeva’s financial guidance reflects its confidence in sustaining growth. For the fiscal fourth quarter ending January 31, 2025, the company expects revenues between $696 million and $699 million, with non-GAAP operating income of approximately $275 million and non-GAAP fully diluted net income per share of around $1.57.

The company’s focus on maintaining high margins and disciplined cost management ensures its ability to invest in product innovation and customer success while driving profitability. However, Veeva has not provided specific commentary on plans to moderate stock-based compensation (SBC) or expand its buyback program beyond the $80.8 million in repurchases completed during FY2024.

Long-Term Growth Drivers

Key long-term drivers for Veeva’s growth include its strong adoption of Vault applications, continued innovation in AI-powered tools, and a commitment to expanding its footprint in untapped markets. By maintaining a dual focus on customer success and product excellence, Veeva is well-positioned to deliver consistent growth in the coming years.

This growth, combined with disciplined financial management and a strong market position, underpins Veeva’s ability to achieve its stated financial goals and sustain its competitive advantage in the life sciences sector.

Shareholder Value and Valuation

Veeva Systems has demonstrated a commitment to returning value to shareholders through stock repurchases, but its impact is offset by substantial stock-based compensation and new stock issuance. Over the past fiscal year, Veeva repurchased $80.8 million worth of its own shares, however, during the same period, the company issued $75.6 million in new common stock, almost matching the value of repurchased shares. Additionally, stock-based compensation totaled $421.1 million, significantly outpacing repurchases by more than five times.

This dynamic indicates that while Veeva is active in buying back stock, the net effect on outstanding shares is modest due to substantial stock-based compensation programs and new stock issuance. Investors should note that this is a common trend in technology companies, where buybacks often aim to offset dilution rather than significantly reduce the share count.

At its current stock price of $210, Veeva trades at a forward price-to-earnings (P/E) ratio of approximately 32.6, based on its FY2025 EPS projection of $6.45. While this valuation reflects a premium, it is justified by the company’s consistent growth, strong margins, and dominant position in a niche but expanding market. However, investors may wish to consider the company’s PEG ratio for further context.

The PEG ratio, which compares the price-to-earnings ratio to the EPS growth rate, currently stands at 3.82, based on an EPS growth rate of 8.53%. A PEG of 1 would require the stock price to drop to approximately $54.99, or the EPS growth rate to increase substantially to 32.56%—a challenging but not impossible target given Veeva’s growth initiatives and market opportunities.

While the stock may appear expensive relative to its growth, Veeva’s fundamentals and its expanding total addressable market justify its valuation. That said, based on current growth rates and valuation metrics, the stock is likely fairly valued at present levels and does not represent a compelling buy opportunity. Investors seeking better entry points may want to wait for a significant pullback or a faster-than-expected acceleration in growth metrics to improve the PEG ratio.

Risks

Despite its strong position, Veeva faces notable risks that could impact its performance. Firstly, the assumptions underpinning its growth projections could prove incorrect. Interest rates may remain higher for longer than anticipated, delaying a recovery in demand and putting pressure on customer spending. Additionally, Veeva may face challenges in up-selling or cross-selling its products, particularly if its offerings fail to resonate with clients or the penetration rate of its portfolio products remains low, as evidenced by today’s sub-15% adoption rate in some areas.

Recently, Veeva implemented a contractual change to standardize termination for convenience (TFC) rights, which allow customers to cancel contracts at their discretion. This change, while creating transparency and flexibility for clients, has affected revenue recognition, reducing the reported revenue growth rate by approximately 2% and creating a minor impact on margins. Management has indicated that this is a one-time issue and does not reflect a decline in demand for Veeva’s services.

Finally, competitive pressures and evolving customer needs may force Veeva to accelerate its innovation timeline, potentially increasing R&D expenses or requiring greater reliance on SBC to attract top talent. If these efforts fail to yield compelling new products or if regulatory environments change unfavorably, Veeva’s growth trajectory could falter.

Conclusion

Veeva Systems continues to demonstrate resilience and innovation, maintaining its leadership in the life sciences cloud software space. However, its current valuation suggests the stock is fairly priced, and it may not present an attractive buying opportunity at this time. With management projecting steady revenue and income growth, the company offers a solid foundation for long-term investors, but challenges such as SBC dilution, competitive pressures, and macroeconomic uncertainties should be closely monitored. For those seeking to invest in Veeva, a pullback or clear signs of accelerated growth could present a better entry point.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult a professional advisor before making investment decisions.