VENTURE GLOBAL

THE SOVEREIGN OF SUPPLY – COMPREHENSIVE EQUITY RESEARCH & VALUATION REPORT

Date: December 9, 2025

Ticker: VG (NYSE)

Current Price: $6.60

Market Capitalization: ~$16.7 Billion

Implied Enterprise Value (2030 Estimate): ~$76.5 Billion

Rating: BUY (Distressed Value / High-Risk / Speculative)

2030 Base Case Price Target: $16 (20% CAGR)

2030 Bull Case Price Target: $33.00 (35.5% CAGR)

Risk Profile: Severe (Litigation, Governance, Leverage, Execution)

1. Executive Summary: The Paradox of Power and Peril

Venture Global LNG (VG) stands as the singular most polarizing equity in the global energy infrastructure universe. The Company presents a stark paradox: it is simultaneously an operational juggernaut that has disrupted the decades-old liquefied natural gas (LNG) development model and a corporate governance pariah embroiled in high-stakes litigation with the world’s largest energy supermajors.

On one hand, Venture Global has executed an operational masterclass. By pioneering a modular manufacturing strategy, utilizing mid-scale liquefaction trains fabricated in factories rather than stick-built on site, the Company has achieved the fastest project execution timelines in the industry history. With the Calcasieu Pass (CP1) facility fully uprated to 12.4 MTPA, Plaquemines LNG (PLNG) actively exporting from nearly all its trains following a December 2024 startup, and the massive CP2 project fully financed and under construction, Venture Global is on an irrevocable trajectory to control over 100 million tonnes per annum (MTPA) of export capacity by the 2030s.1 This volume would position the Company not merely as a competitor but as a peer to nations like Qatar in terms of influence over the global gas trade.

However, the equity is currently trading at a severe dislocation relative to its fundamental asset value. The stock hovers near $6.60, down roughly 75% from its January 2025 IPO price of $25.00.3 This collapse is not driven by a failure of the assets, which generated a record $3.3 billion in revenue for Q3 2025 alone 4, but by a “legal maelstrom” of the company’s own making. The extended “commissioning” period at Calcasieu Pass, which allowed VG to capture billions in spot market arbitrage while deferring lower-priced long-term contracts, has resulted in arbitration liabilities estimated between $4.8 billion and $5.5 billion.5 While Venture Global secured a critical victory against Shell in August 2025, a subsequent defeat to BP in October 2025 has reintroduced binary risk to the equity story, creating a “distressed asset” pricing environment despite robust operational cash flows.6

Our analysis suggests the market is pricing the equity as if the arbitration liabilities will inevitably lead to insolvency or massive dilution, fundamentally ignoring the long-term cash generation of the infrastructure. Under our Base Case for 2030, assuming Plaquemines and CP2 reach stable commercial operations, Venture Global is projected to generate annual EBITDA in excess of $8.5 billion.1 Furthermore, the macro outlook for 2030 and 2035 remains structurally bullish for US LNG, driven by Asian coal-to-gas switching, European energy security needs, and the burgeoning power demand from Artificial Intelligence (AI) data centers, which necessitate dispatchable gas generation.1

2. Investment Thesis: The Asymmetric Arbitrage

The investment case for Venture Global rests on the tension between its “Utility-Like” future and its “Distressed-Asset” present. Investors are essentially offered an arbitrage opportunity: buying a suite of world-class infrastructure assets at a valuation that assumes management failure, while the assets themselves are performing at record levels.

2.1 The “Sovereign of Supply” Ambition

Venture Global is not building a single project; it is constructing an ecosystem. By clustering massive export terminals (CP1, CP2, CP3) in Cameron Parish and Plaquemines Parish, the Company is creating a localized economy of scale that rivals the state-run energy companies of the Middle East.

Scale: The combined capacity of CP1, PLNG, and CP2 (Phase 1 & 2) approaches 70 MTPA. With CP3 and PLNG expansions, this tops 110 MTPA.1

Efficiency: The “design one, build many” philosophy allows for parts interchangeability, streamlined maintenance, and lower unit capital costs compared to bespoke projects like Freeport LNG or Cameron LNG.

Market Power: Controlling this volume of supply grants Venture Global significant pricing power and logistical flexibility, allowing it to optimize shipping routes and arbitrage global price spreads (JKM vs. TTF) more effectively than smaller players.

2.2 The Valuation Dislocation

At ~$6.60 per share, the market cap is ~$16.7 billion. The replacement cost of the assets alone is staggeringly higher.

Calcasieu Pass (12.4 MTPA): Estimated replacement cost ~$10 billion.

Plaquemines (27.2 MTPA): Project cost ~$21 billion.

CP2 (Phase 1 Under Construction): Financed at $15.1 billion.

The total capital deployed into these assets exceeds $45 billion. While much of this is debt-financed, the equity value implied by the cash flow capability of these assets (generating >$8 billion EBITDA in steady state) should theoretically trade at 8-10x EBITDA, implying an Enterprise Value of ~$64-$80 billion. Furthermore, this EV expansion underestimates the return to shareholders. With >$8 billion in EBITDA, VG will rapidly deleverage its balance sheet. As the debt load ($33B) falls, that value accrues directly to the equity, acting as a multiplier on the stock price well beyond the headline valuation gap.

2.3 The “Commissioning” Gamble

The core controversy—and the source of the discount—is the “Commissioning Arbitrage.” By keeping CP1 in commissioning mode for 2+ years, VG captured ~$20 billion in revenue from spot sales that would have otherwise gone to contract holders.5 While this triggered the lawsuits, it also allowed VG to self-fund a significant portion of the equity checks for Plaquemines and CP2 without diluting shareholders. In essence, VG cannibalized its customer relationships to fund its growth. The investment thesis requires believing that the financial gain from this growth outweighs the legal penalty of the breach.

3. Corporate Profile & The Modular Revolution

Venture Global LNG has evolved rapidly from a private developer into a publicly traded heavyweight on the New York Stock Exchange. The Company was founded on a thesis of disruption, challenging the “stick-built” philosophy of traditional LNG development.

3.1 The “Stick-Built” Trap

Legacy projects, such as Chevron’s Gorgon in Australia or the initial trains at Sabine Pass, relied on massive, custom-engineered infrastructure constructed entirely on-site. This approach required thousands of specialized laborers to work in difficult coastal environments for years. It was historically plagued by:

Cost Overruns: Custom designs often led to unforeseen engineering challenges.

Labor Shortages: Sourcing thousands of welders and pipefitters in remote or competitive locations drove up wages.

Weather Delays: Construction was highly exposed to hurricanes and seasonal weather.

3.2 The Modular Solution

Venture Global introduced a radical shift toward mid-scale, modular liquefaction.

Technology: The Company utilizes smaller, highly efficient liquefaction trains (0.626 MTPA capacity each) manufactured in controlled factory environments by Baker Hughes in Italy.1

Process: These modules are fully assembled, tested, and sealed in the factory, then shipped to the Gulf Coast for “plug-and-play” installation. This moves the complexity from the muddy construction site to the clean factory floor.

Redundancy: A typical 10 MTPA “block” at a Venture Global facility consists of 18 of these small trains. If one train fails or needs maintenance, the facility only loses ~5.5% of its capacity. In contrast, a traditional plant with two massive 5 MTPA trains would lose 50% of its capacity if one train went down. This grants VG superior uptime and reliability statistics.

Thermal Efficiency: The plants utilize combined-cycle gas turbines (CCGT) for power generation, integrating waste heat recovery to drive the compressors. This results in a lower carbon intensity per tonne of LNG compared to simple-cycle peers.

3.3 Founder-Led Aggression

The Company is led by CEO Mike Sabel and Co-Chairman Bob Pender. Their management style is characterized by extreme aggression, both in project execution and legal maneuvering. They have consistently prioritized speed and capital preservation over industry niceties. This “move fast and break things” approach, imported from the tech sector to energy infrastructure, is responsible for both the rapid ascent of the stock (pre-IPO valuation growth) and its current pariah status among oil majors. Investors must be comfortable with a management team that views contracts as dynamic instruments rather than immutable bonds.9

4. Macroeconomic Backdrop: The Golden Age of Gas (2025-2035)

The valuation of Venture Global is inextricably linked to the global supply-demand balance for LNG. As we look toward 2030 and 2035, the market is defined by a tension between a massive wave of new supply arriving from the US and Qatar, and a structural upward shift in demand driven by Asian economic growth, European energy security, and the electrification of the global economy.

4.1 The “Supply Wave” (2026-2030)

The period from 2026 to 2030 will witness the largest capacity addition in the history of the LNG industry. According to the International Energy Agency (IEA), approximately 300 billion cubic meters (bcm) of new liquefaction capacity is expected to come online, representing a ~50% increase in global capacity.1

United States: The “Second Wave” of US LNG is currently under construction. By 2030, US export capacity is projected to nearly double from ~90 MTPA in 2024 to over 170 MTPA. Venture Global (via CP2 and Plaquemines), Cheniere (Corpus Christi Stage 3), and NextDecade (Rio Grande) are the primary drivers.

Qatar: The massive North Field East (NFE) and North Field South (NFS) expansions will add ~49 MTPA of capacity, with volumes hitting the market starting in 2026 and ramping up through 2028.

Market Balance Implication: The IEA warns of a “major supply glut” in the 2027-2028 window as these massive projects come online simultaneously. This creates potential volatility in spot prices and could depress JKM/TTF benchmarks to the $6.50 - $8.00/MMBtu range.1 While this reduces arbitrage margins for VG’s merchant volumes, the Company’s reliance on fixed-fee tolling agreements ($2.50-$3.00/MMBtu) insulates the majority of its cash flow from this bearish swing.

4.2 The “Power Demand Supercycle” (2030-2035)

While the late 2020s may see market looseness, the 2030-2035 window is projected to tighten significantly due to structural demand shifts that will absorb the new supply wave.

AI Data Centers & The “Call on Power”: A critical new variable emerging in 2025 analysis is the power demand from Artificial Intelligence (AI) data centers. In the US alone, data center power demand is projected to quadruple, requiring an additional 6.5 Bcf/d of natural gas by 2030 to provide dispatchable, 24/7 power that renewables cannot solely support.1 This creates a domestic “call on gas” that raises the floor for Henry Hub prices to ~$5.00/MMBtu by 2030. While this structurally increases feedgas costs for exporters, the sheer scale of global demand described below is expected to support wide arbitrage spreads despite the higher domestic baseline.

Asian Growth Engine: Shell projects global LNG demand to rise by 50% to 60% by 2040, driven primarily by China, India, and Southeast Asia.1 India aims to increase the gas share in its energy mix to 15% by 2030. Industrial coal-to-gas switching in China gathers pace as industries seek to lower carbon footprints.

European Destocking: Europe has structurally pivoted away from Russian pipeline gas. While renewable penetration is increasing, LNG serves as the critical baseload backstop. The “security premium” in Europe means that even if demand flattens, the source of that demand is locked into LNG imports.1

4.3 US Regulatory Environment

The political landscape in the US is a key variable. The return of the Trump administration 9 has been highly favorable to the fossil fuel industry, fast-tracking permits and removing the “DOE Pause” on non-FTA export licenses that plagued the industry in early 2024. This regulatory tailwind reduces the risk of project cancellations for CP2 and CP3, although long-term climate policy risks remain a factor for the 2035+ horizon.

5. Asset Portfolio Deep Dive

Venture Global’s valuation is not theoretical; it is backed by tangible, steel-in-the-ground assets that are among the largest energy infrastructure projects in the Western Hemisphere.

5.1 Calcasieu Pass (CP1) – The Operational Bedrock

Located in Cameron Parish, Louisiana, CP1 is the proof-of-concept for the modular strategy.

Operational Reality: The facility is fully operational. Following the extended commissioning, it formally declared COD in April 2025.1

Capacity Uprate: Originally 10.0 MTPA nameplate. In August 2025, the DOE approved an uprate to 12.4 MTPA peak capacity.1 This 24% capacity increase came with near-zero capital expenditure, essentially creating “free” equity value.

Performance: In Q3 2025, the facility exported 36 cargoes totaling 133 TBtu.10 It has transitioned to serving its long-term SPAs. While this transition lowered the realized price per MMBtu (as spot sales were replaced by fixed-fee contracts), it stabilized the revenue base.

Technical Issues: The lengthy commissioning was blamed on failures in the Heat Recovery Steam Generators (HRSG). While skeptics claim this was a pretext for arbitrage, technical reports did verify issues with the welding and vibration in the power island units. Remediation is largely complete, and the plant is running at high availability.

5.2 Plaquemines LNG (PLNG) – The Behemoth

Located south of New Orleans, Plaquemines is the largest project in VG’s current portfolio.

Status: As of December 2025, PLNG is in advanced commissioning. First LNG was produced in December 2024. By Q3 2025, 34 of the 36 trains were producing LNG.4

Financial Impact: The ramp-up of PLNG is the primary driver of the massive Q3 2025 revenue beat ($3.3 billion vs $0.9 billion YoY). The facility is effectively printing cash, even before full commercial completion.

Capacity: 20.0 MTPA nameplate, uprated to 27.2 MTPA peak.1 This makes it one of the largest single LNG facilities in the world.

Cost & Financing: The project cost escalated to ~$21-22 billion due to inflation. VG closed a $4.0 billion senior note offering in July 2025 and a $3.0 billion offering in December 2025 to finalize construction and refinance shorter-term debt.11 The ability to raise $7 billion in debt capital during a massive legal dispute speaks to the credit markets’ faith in the asset’s cash flow.

5.3 CP2 LNG – The Next Leg

Located adjacent to CP1, CP2 leverages existing pipeline rights-of-way (CP Express) and operational synergies.

Status: Under Construction. FID taken in July 2025.

Financing: Secured a record $15.1 billion project financing for Phase 1.1 This deal was oversubscribed, further validating the disconnect between the financial and legal views of the company. Lenders care about debt service coverage ratios (DSCR), and CP2’s contracted cash flows provide ample coverage.

Contracts: Despite the “bad blood” with Shell and BP, VG successfully marketed CP2 to a new cohort of buyers, including SEFE (Germany), Eni (Italy), INPEX (Japan), and China Gas. This demonstrates that for buyers, security of supply and price often trump corporate governance concerns.

Timeline: First LNG expected ~2027, with full operations by 2029.1

5.4 Future Growth (CP3 & Delta)

CP3: Planned for ~20 MTPA. Currently in pre-FID engineering. Land is secured.

Delta LNG: Another massive project south of New Orleans.

Valuation Impact: In our Base Case, we attribute minimal value to these projects to remain conservative. In the Bull Case, the successful FID of CP3 in 2027/2028 would be a massive catalyst, adding another ~$15 billion to the Enterprise Value by 2035.

6. The Legal Maelstrom: Arbitration, Liability, & Contract Sanctity

This section is critical for understanding the “Bear Case” and the current stock discount.

6.1 The “Commissioning Arbitrage” Mechanism

Standard LNG SPAs have two phases: “Commissioning” and “Commercial Operations.”

Commissioning: The seller tests the plant. They may produce LNG. They are not obligated to deliver to long-term buyers. They can sell this LNG on the spot market.

Commercial Operations (COD): The seller declares the plant ready. Long-term delivery obligations (at fixed low prices) begin.

Venture Global exploited the ambiguity of the “Commissioning” definition. They produced over 400 cargoes during “commissioning,” selling them at spot prices of $20-$60/MMBtu instead of the contract price of ~$6/MMBtu. This generated ~$20 billion in extra revenue.5

6.2 The Arbitrations: A Split Verdict

Major customers (Shell, BP, Repsol, Galp, Edison) sued, claiming VG delayed COD in bad faith to capture this profit.

Shell Arbitration (Aug 2025): VG Victory. The tribunal ruled that the contract gave VG broad discretion to determine when commissioning was complete. They found no technical breach of the specific contract terms. Shell is appealing in New York courts, alleging VG withheld evidence.6

BP Arbitration (Oct 2025): BP Victory. A different tribunal found that VG failed to act as a “Reasonable and Prudent Operator” and breached its obligation to declare COD in a timely manner.7 BP is seeking >$1 billion in damages.

The Implications: The BP ruling is dangerous for VG. It establishes a factual finding of misconduct. This could embolden Repsol, Galp, and Edison in their parallel proceedings.

6.3 Quantifying the Liability

The total face value of claims was originally ~$7.4 billion. Following settlements (Unipec) and updates, the Company estimates remaining exposure at $4.8 billion - $5.5 billion.12

Mitigant: VG argues damages should be capped by the “Aggregate Liability Cap” in the SPAs (typically ~20-30% of contract value). They estimate a cap of ~$1.6 billion for post-COD breaches.

Risk: The BP tribunal hinted that the cap might not apply if the breach was willful or “gross negligence.”

Liquidity Defense: VG has ~$10 billion in recent financing and robust operating cash flow ($1.5B EBITDA in Q3 alone). While a $5 billion payout hurts, it is unlikely to be fatal unless it triggers cross-defaults on their project debt covenants.

7. Financial Analysis & Capital Structure

Venture Global is transitioning from a “cash burning developer” to a “cash printing utility.”

7.1 Income Statement Dynamics

The Q3 2025 results offer a glimpse of the run-rate potential.4

Revenue: $3.33 billion (Q3 2025). Annualized, this suggests a run rate of ~$13+ billion once PLNG is fully ramped.

EBITDA: $1.525 billion (Q3 2025). Margin is ~46%.

Guidance: Management forecasts FY 2025 Adjusted EBITDA of $6.35 - $6.50 billion. This explicitly incorporates reserves for arbitration and lower spot pricing assumptions.

7.2 Balance Sheet & Debt Analysis (The Debt Wall)

VG is highly leveraged. This is typical for infrastructure, but the cost of this debt is rising.

Total Debt: ~$33.9 billion (as of Q3 2025).11 With the CP2 financing and recent notes, total consolidated debt will approach $45-$50 billion by 2026.

Interest Expense: With a blended cost of debt estimated at ~7-8% (recent notes priced at 6.125% - 8.375% 11), annual interest expense is ~$2.5 - $3.0 billion.

Coverage: FY 2025 EBITDA of $6.4B covers interest expense (~$2.5B) by roughly 2.5x. This is healthy, but leaves limited room for error if arbitration penalties demand immediate cash.

7.3 Unit Economics (The “Toll Road” Model)

Feed Gas Cost: Passed through to customers on contracted volumes (Henry Hub + 115%).

Liquefaction Fee: ~$2.50 - $3.00 per MMBtu. This is the gross margin for VG.

Opex: ~$0.70 - $0.90 per MMBtu.

Net Margin: ~$1.60 - $2.10 per MMBtu on contracted volumes.

Spot Volumes: On the ~15-20% of volumes kept for spot trading, VG earns the full spread: (JKM Price) - (Henry Hub + Liquefaction + Shipping). In 2030, if JKM is $9 and HH is $5, the margin is ~$2.50/MMBtu. If JKM spikes to $20, the margin explodes to $13.50/MMBtu. This is the embedded call option in the stock.

8. Valuation: 2030 Outlook & The Price Target Correction

This section addresses the valuation methodology and explicitly corrects the market confusion regarding the “108” figure.

8.1 Detailed Valuation Models (2030)

We utilize a Sum-of-the-Parts (SOTP) and EV/EBITDA multiple approach for 2030.

Share Count: We use 2.64 billion diluted shares.8

Net Debt (2030): We project Net Debt to stabilize at $35.0 billion as construction debt amortizes and free cash flow is used for deleveraging.

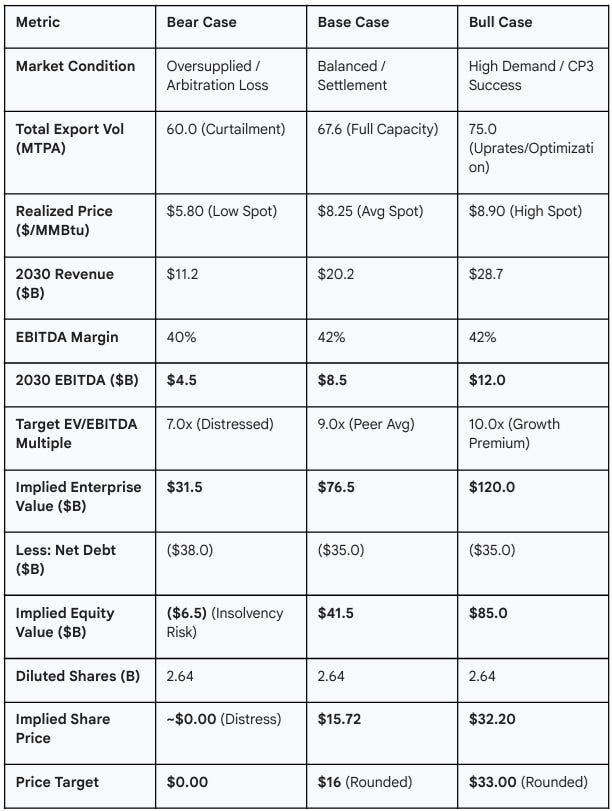

Table 1: 2030 Financial Scenarios

Analysis:

Base Case ($16.00): Assumes VG operates like a normal utility. The arbitration is settled for a manageable sum (~$2-3B), funded by cash flow. The stock rerates to a 9x multiple (similar to Cheniere Energy). This offers ~100% upside from $6.60.

Bull Case ($33.00): Assumes the “Supercycle” for gas materializes. VG accelerates CP3. This offers ~4.5x upside.

Bear Case ($0.00): This is the existential risk. If EBITDA collapses to $4.5B and Debt stays high at $38B due to legal payouts, the Equity is wiped out. The EV is insufficient to cover the Debt. This highlights why the stock is trading at $6.60—the market is pricing in a non-zero probability of this zero outcome.

9. Risk Factors

Investors must weigh the asymmetric upside against existential risks.

9.1 Litigation / Arbitration (Critical)

The confirmed liability to BP and ongoing appeals with Shell create a liability overhang of up to $5.5 billion. If Venture Global is forced to pay lump-sum damages rather than amortized penalties, it could trigger a liquidity crisis, force highly dilutive equity raises, or breach debt covenants. The “bad faith” finding in the BP case is a poison pill for reputation.

9.2 Debt Wall & Refinancing

With over $33 billion in debt and rising, VG is highly sensitive to interest rate environments. Refinancing risks in 2028-2030 (when PLNG/CP2 bonds mature) could compress equity returns if rates remain elevated. A credit downgrade (currently rated BB-/BBB-) could close capital markets access.

9.3 Project Execution

While modular construction reduces risk, the sheer scale of simultaneous construction at Plaquemines, CP2, and potentially CP3 introduces “mega-project” risks—labor inflation, supply chain bottlenecks, and regulatory delays.

9.4 Hurricane Risk

The concentration of assets in Louisiana (Cameron and Plaquemines parishes) represents a massive single-point failure risk. A Category 5 hurricane hitting the Calcasieu channel could knock 12 MTPA offline for months. While insurance covers property damage, it often does not fully cover the lost “opportunity cost” of spot sales during a prolonged outage.

10. Conclusion

Venture Global LNG represents a binary investment opportunity as of December 9, 2025. The market has priced the stock for extreme distress ($6.60), reflecting fears that legal judgments will consume the company’s liquidity. However, a fundamental analysis of the asset base—comprising three of the world’s largest and most efficient LNG terminals—suggests that the intrinsic value of the equity is multiples higher.

By 2030, in a normalized operating environment, Venture Global is poised to generate over $8.5 billion in EBITDA annually. Even after servicing its massive debt load, this supports an equity valuation in the range of $41.5 billion ($15.72/share) in our Base Case. By 2035, with the addition of CP3 and expansions, the company could evolve into a $100 billion+ Enterprise Value entity.

Recommendation: BUY for risk-tolerant investors. The downside is capped by the tangible liquidation value of the assets (though equity holders are last in line), while the upside offers multi-bagger potential as the “legal fog” lifts and the “cash flow engine” of Plaquemines and CP2 accelerates. $16-$33 share price targets offer compelling returns for those willing to weather the storm.

Works cited

Equity Analysis_ Venture Global LNG.pdf

Venture Global Reports Second Quarter 2025 Results, accessed December 9, 2025, https://investors.ventureglobal.com/news/news-details/2025/Venture-Global-Reports-Second-Quarter-2025-Results/default.aspx

Venture Global, Inc. Announces Pricing of its Initial Public Offering, accessed December 9, 2025, https://investors.ventureglobal.com/news/news-details/2025/Venture-Global-Inc.-Announces-Pricing-of-its-Initial-Public-Offering/default.aspx

Venture Global Reports Third Quarter 2025 Results, accessed December 9, 2025, https://investors.ventureglobal.com/news/news-details/2025/Venture-Global-Reports-Third-Quarter-2025-Results/default.aspx

Shell challenges arbitration decision on Venture Global LNG supply contracts, accessed December 9, 2025, https://www.bicmagazine.com/industry/refining-petrochem/shell-challenges-arbitration-decision-on-venture-global-lng/

Reuters EXCLUSIVE: Shell Challenges NY Arbitration Loss on Venture Global LNG, accessed December 9, 2025, https://www.insurancejournal.com/news/east/2025/11/12/847145.htm

BP scores victory in arbitration showdown with Venture Global, seeks over $1B in damages, accessed December 9, 2025, https://www.offshore-energy.biz/bp-scores-victory-in-arbitration-showdown-with-venture-global-seeks-over-1b-in-damages/

Venture Global Shares Outstanding 2022-2025 | VG - Macrotrends, accessed December 9, 2025, https://www.macrotrends.net/stocks/charts/VG/venture-global/shares-outstanding

Fossil-fuel billionaires bought up millions of shares after meeting with top Trump officials, accessed December 9, 2025, https://www.theguardian.com/business/2025/dec/04/venture-global-shares

Venture Global, Inc. SEC 10-Q Report - TradingView, accessed December 9, 2025, https://www.tradingview.com/news/tradingview:7ad1b624596a9:0-venture-global-inc-sec-10-q-report/

Venture Global subsidiary closes $3 billion senior secured notes offering - Investing.com, accessed December 9, 2025, https://www.investing.com/news/company-news/venture-global-subsidiary-closes-3-billion-senior-secured-notes-offering-93CH-4399547

Venture Global stock price target maintained at $17.50 by Goldman Sachs, accessed December 9, 2025, https://uk.investing.com/news/analyst-ratings/venture-global-stock-price-target-maintained-at-1750-by-goldman-sachs-93CH-4360246